Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

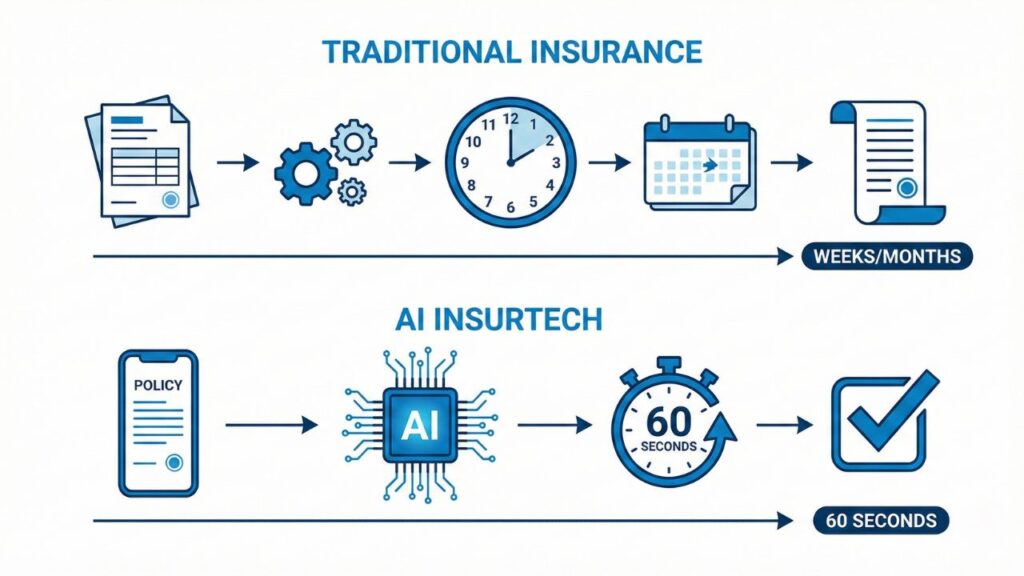

The Hook For decades, getting car insurance has been a slow, paperwork-heavy process filled with lengthy questionnaires and waiting periods. Whether you are buying a new car or renewing a policy, the traditional model feels stuck in the past. But today, Artificial Intelligence is completely changing the landscape, transforming a multi-day ordeal into a frictionless, instant transaction.

What is Ominimo? Enter Ominimo AI, an innovative, AI-powered insurtech startup that provides a fully digital auto insurance experience. Founded by former McKinsey consultants and currently valued at over $220 million with heavy backing from industry giants like Zurich Insurance, Ominimo is proving that the future of the insurance industry lies in deep tech and automation.

The Core Promise The platform’s main selling point is its speed and simplicity: delivering a highly personalized 60-second auto insurance quote through automated data processing. By rethinking the underwriting process from the ground up, Ominimo has stripped away the friction, allowing users to secure coverage faster than it takes to brew a cup of coffee.

Setting a New Global Standard As consumer expectations shift toward instant, mobile-first solutions, platforms like Ominimo are setting a new global standard for how modern drivers buy and manage insurance. They represent the “Amazonification” of the auto insurance market—proving that a fully digital auto insurance platform is what premium drivers in the US, UK, and beyond are actively looking for.

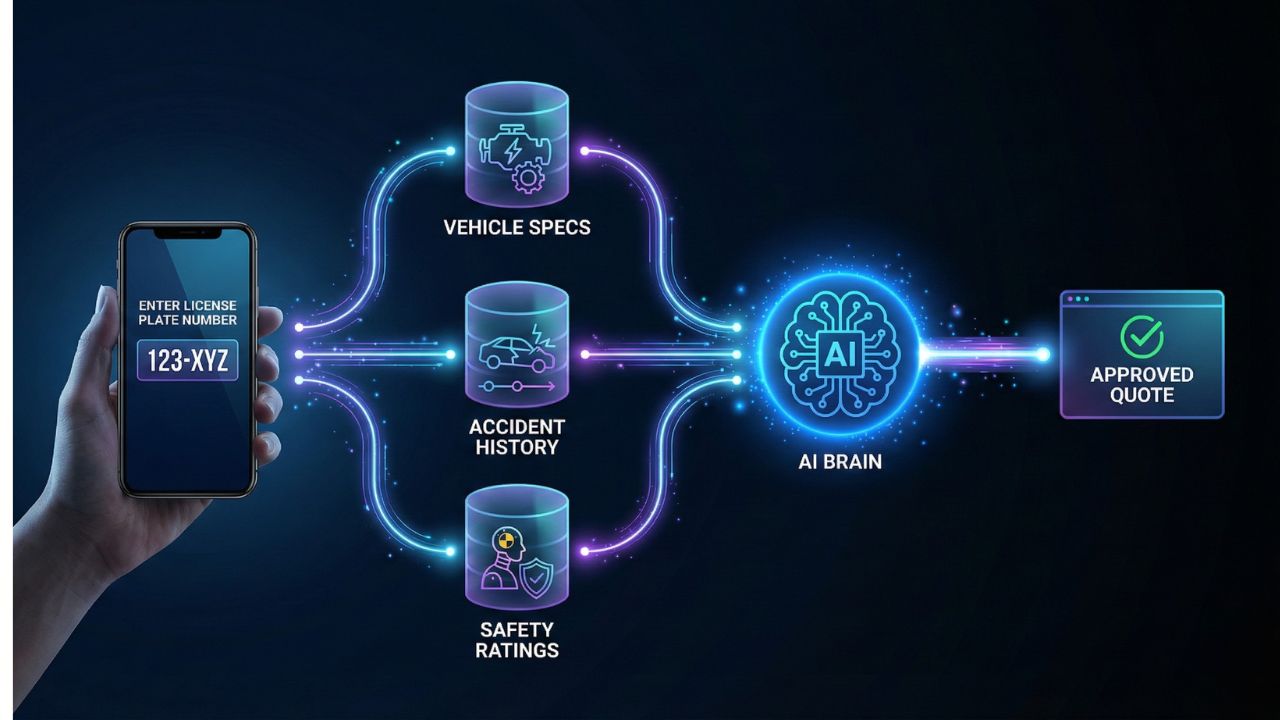

Machine Learning for Fair Pricing Traditional insurers typically rely on just five or six broad demographic variables—like age, zip code, and vehicle type—to calculate your premium. Ominimo uses advanced machine learning for car insurance pricing to assess risk with surgical precision.

Their proprietary algorithms analyze hundreds of unique data points in real-time, including hyper-specific details like vehicle dimensions, urban traffic density, and weather patterns. Instead of grouping drivers into broad, unfair categories, the AI identifies genuinely careful drivers and rewards them, resulting in premiums that are often up to 30% cheaper than the market average.

Eliminating the Questionnaires The secret behind the 60-second quote is how the technology works behind the scenes. Ominimo bypasses the dreaded “50-question survey” by integrating directly with secure public databases.

Users simply enter basic, essential details—such as their license plate number—and the AI instantly pulls the remaining 100+ variables needed to assess the vehicle. This data enrichment eliminates manual data entry and drastically reduces the chance of human error.

Lowering Overhead Costs Because the artificial intelligence engine handles the heavy lifting of data analysis and risk assessment, Ominimo operates with incredible financial efficiency. The company doesn’t need to maintain costly physical branch locations or employ massive teams of manual underwriters. By operating as a lean, tech-first entity, they pass these massive overhead savings directly to the customer in the form of lower daily rates.

Mobile-First Approach Modern consumers manage their banking, shopping, and travel from their phones; insurance should be no different. Ominimo takes a strictly mobile-first approach, allowing users to manage their entire policy through a highly intuitive smartphone app or web portal. From modifying coverage limits to accessing digital proof of insurance, everything is available 24/7 with a few taps.

Filing Claims Online The true test of any AI-powered insurtech startup is how it handles accidents. Ominimo has shifted away from the frustrating process of calling a claims adjuster during business hours and waiting on hold. Instead, they offer non-stop digital customer support and streamlined online claim processing. In markets like the Netherlands, they have even partnered with digital repair networks to offer a fully automated, transparent vehicle repair journey, bringing claim resolution times down to a matter of days.

Financial Security (The SIGNAL IDUNA Partnership) While tech startups are exciting, insurance requires guaranteed financial security. Consumers need to know their claims will actually be paid out. Ominimo perfectly bridges this gap. While the front-end technology is a disruptive startup, their financial backing and risk carrying come from established, century-old European insurance giants like SIGNAL IDUNA (and in broader European markets, Zurich Insurance Group). This strategic partnership proves that the speed of modern AI tech can safely and reliably partner with traditional financial security.

The Global Insurtech Shift While Ominimo was born in the European market, it represents the exact business model that US and UK consumers are currently demanding: fast, app-based, and highly affordable. The global insurtech shift in the US and UK is accelerating at an unprecedented pace. In fact, recent 2026 market data projects the global insurtech market to cross $30 billion this year, with the UK insurtech sector alone valued at over $53 billion and growing at an 8% CAGR.

Consumers in these major markets are tired of legacy carriers that rely on outdated mainframe technology. As inflation squeezes household budgets, the demand for AI-powered car insurance platforms that can dynamically assess risk and lower premiums has never been higher. Agile startups are capturing early market share precisely because they can deploy technology that traditional, tier-1 insurers struggle to integrate.

The “Amazonification” of Insurance We are currently witnessing the “Amazonification” of the insurance industry. Modern consumers expect to buy insurance as easily and intuitively as they add a product to their cart on Amazon. They want transparent pricing, one-click checkout flows, and instant digital fulfillment.

Legacy US and UK insurers are facing a stark reality: adapt or become obsolete. Older platforms that require phone calls to brokers, physical paperwork, or week-long underwriting periods are fundamentally incompatible with the modern buyer’s journey. By adopting Ominimo’s 60-second quote model—where embedded insurance APIs and machine learning do the heavy lifting instantly—traditional carriers could modernize their offerings and survive the transition to a purely digital economy.

Privacy and Data Security When an AI platform asks for personal details to calculate a rate, the immediate question is: Is my data safe? The intersection of AI auto insurance, GDPR compliance, and data security is a critical focus for premium markets.

Because Ominimo operates under the European Union’s strict General Data Protection Regulation (GDPR), its data handling practices are world-class. AI platforms manage sensitive user data securely by employing techniques like data pseudonymization (removing identifying markers from data before the AI analyzes it) and strict purpose limitation (ensuring your data is only used to calculate your rate, not sold to third-party marketers). This built-in privacy-by-design approach resonates strongly with UK and US consumers who are increasingly protective of their digital footprints.

The traditional auto insurance model is being entirely rewritten. Ominimo is utilizing advanced Artificial Intelligence to make auto insurance exponentially faster, significantly cheaper, and completely paperless. By leveraging machine learning to assess risk fairly and eliminating the bloated overhead of physical branches, they are passing real savings directly to the modern driver.

Ultimately, the success of platforms like Ominimo AI proves that technology is permanently disrupting the auto insurance market worldwide. We have reached a tipping point where consumers no longer tolerate friction. As AI models become smarter and integrations with public databases become more seamless, the 60-second, fully digital insurance quote will transition from a startup luxury to an industry-wide standard.

Over to You! The insurtech revolution is here, but we want to hear from you. Would you trust an AI algorithm to handle your auto insurance if it meant saving 30% on your premium? Or do you still prefer the reassurance of a human broker?

Drop your thoughts in the comments below, and don’t forget to share this article with anyone who is tired of overpaying for their car insurance!